Family offices are as varied–in structure, size and strategy–as the individuals and families whose money is being managed. By leveraging our extensive experience across corporate, regulatory, tax and litigation practices, we provide a single source of best-in-class advice to single- and multi-family offices throughout the United States and globally.

We assemble multidisciplinary teams from our leading M&A, investment funds, regulatory, financing, exempt organizations, tax and personal planning practices. When necessary, we also collaborate closely with a family office’s other advisors, including accountants, investment advisors and lifestyle advisors. By taking this type of holistic approach, we are able to address the complex and often unique legal and regulatory issues our family office clients face and provide bespoke and tailored solutions to fit each of our client’s diverse needs.

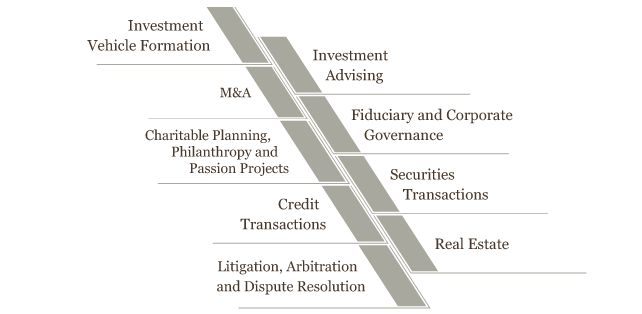

Suite of Family Office Services at Formation:

Suite of Family Office Services for Deployment of Capital and Ongoing Operations of a Family Office:

Our diverse formation work with family office clients has included:

- Developing family office structures, including limited liability companies and private family trust companies, and evaluating costs, ownership and control issues

- Structuring family office investment vehicles, taking into consideration questions surrounding ownership, deduction of investment expenses, tax planning, pooled investment vehicles, incentive compensation and investment or withdrawal restrictions

- Providing strategic solutions related to hiring or spinning out key employees, entity control and concerns regarding family clients and affiliated family offices

- Drafting employment, retention, severance and non-disparagement agreements, as well as creating incentive compensations structures, for family office employees

- Reorganizing family business and creating succession plans

- Drafting investment advisory agreements

- Drafting shareholders agreements for family-owned businesses

- Advising on matters related to philanthropy and passion projects, such as the development and operation of tax-exempt organizations, including private foundations, supporting organizations and donor-advised funds, and related tax compliance matters

Our diverse work with family office clients related to the deployment of capital or ongoing operations has included:

- Reviewing and negotiating investments in private funds across asset classes, such as private equity funds, hedge funds, venture capital funds and growth funds, investments in real estate, direct equity investments in operating companies and investments in separately-managed accounts or funds-of-one

- Advising on investment policies for family office clients

- Engaging in mergers and acquisition related work, including investments in private deals, seed investments and purchase or sale of minority stakes

- Advising on securities and HSR filings

- Completing block sales and other securities sales

-

Structuring and providing compliance advice on expense-sharing arrangements and service agreements between family offices and related charitable entities

- Assisting with various debt financings, including traditional credit facilities, lines of credit and margin loans financing the acquisitions of securities, art, aircraft and/or other personal property

- Providing guidance in various real estate matters

- Providing guidance on the administration of family offices and private trust companies

- Representation of family offices, fund founders and charitable foundation trustees in various litigations, arbitrations and disputes

Featured Matters

| Representation of senior executives at leading investment banks in the formation of family offices utilizing the Lender structure |

| Representation of a retired senior executive of a major alternative asset manager in the formation of an affiliated family office to accommodate the structuring of a private real estate investment with third party co-investors |

| Representation of senior executive of a top-tier alternative asset manager in the formation of a family office and related initial investment vehicles |

| Representation of retired senior executive of a major alternative asset manager in the formation and ongoing management of a private trust company |

| Restructuring of several family offices to achieve family-specific goals, such as to provide asset protection and fiduciary liability protection on the acquisition of a high-risk asset and to restructure ownership to maximize privacy and separate out management of certain assets to reduce family conflict |

| Representation of a family trust associated with the original founding family of a large-scale branded food company |

Representation of a family office in connection with the spin-out of its private equity team, and related tax and employment matters following departure of certain key employees along with the restructuring of the team investment vehicle

|

Representation of a family office in a margin loan financing on shares of a publically traded media company

|

| Representation of lenders in the extension of margin loan financing to a founder, secured on shares of a publically traded technology-media company, as well as representation of a lender in the extension of multiple margin loan financings to a founder, secured on shares of a publically traded e-commerce company |

| Representation of family offices and dealers in numerous equity hedging transactions entered into by family offices, including variable share prepaid forwards, collars and covered call transactions |